While median sale prices rose in most of the Baltimore region’s real estate market in March, the number of homes sold declined, according to the Long & Foster Market Minute reports. The Baltimore region includes Baltimore, Anne Arundel, Carroll, Howard and Harford counties and the city of Baltimore.

While median sale prices rose in most of the Baltimore region’s real estate market in March, the number of homes sold declined, according to the Long & Foster Market Minute reports. The Baltimore region includes Baltimore, Anne Arundel, Carroll, Howard and Harford counties and the city of Baltimore.

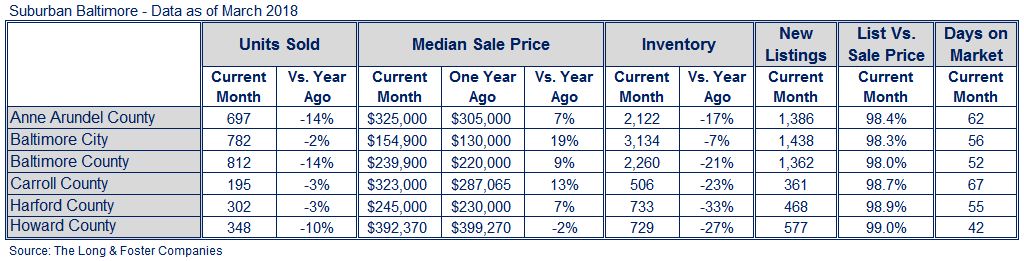

The number of homes sold in the Baltimore region decreased in March when compared to the same month in 2017. The declines ranged from a 2 percent dip in Baltimore City to a 14 percent drop in both Anne Arundel and Baltimore counties. Meanwhile, median sale prices increased in most of the region, with Baltimore City experiencing a 19 percent increase and Carroll County experiencing a 13 percent increase.

Active inventory fell by double digits in all but one part of the Baltimore region in March. Baltimore City saw a 7 percent decline, and all other areas experienced decreases between 17 percent and 33 percent. Homes sold at a steady pace throughout the region, with days on market averages ranging from 42 days to 67 days.

“There’s never been a better time to sell,” said Gary Scott, president of Long & Foster Real Estate. “But the choices of where to go are challenging and there are a lot of different factors impacting inventory. For current homeowners, many Boomers are choosing to age in place while others are deciding that downsizing isn’t cost effective. Younger homeowners looking to move up fear they won’t find what they want on the market.”

Scott said one group of homeowners who could benefit significantly by selling is those who became landlords during the recession because they were underwater on their mortgage. Putting their home on the market now would help them maximize the return on their investment.

Some homeowners are trying to maximize the sale of their property by listing it with a discount brokerage, but that could end up costing them more, Scott warns. The barrier to entry to get a real estate license is fairly low, and the cost of discount brokerages is often reflective of the skills and services offered. A home seller may pay a lower commission, but their agent may not be as skilled in negotiations or be as knowledgeable about real estate contracts.

“When hiring a real estate agent, you want to ask them result-oriented questions,” Scott said. “Ask them what percentage of their listings sell, what their list-to-sale price ratios are, as well as the difference between a home’s original price and its sale price. Just because a real estate agent lists a lot of homes doesn’t mean they’ll provide the level of service that’s best for each client.”

The Long & Foster Market Minute is an overview of market statistics based on residential real estate transactions for more than 500 local areas and neighborhoods and over 100 counties in eight states. The easy-to-read, easy-to-share reports include information about each area’s units sold, active inventory, median sale prices, list to sold price ratio, days on market and more.

Information included in this report is based on data supplied by Metropolitan Regional Information System and its member associations of Realtors, which are not responsible for its accuracy. The reports include residential real estate transactions within specific geographic regions, not just Long & Foster sales, and they do not reflect all activity in the marketplace. Information contained in this report is deemed reliable but not guaranteed, should be independently verified, and does not constitute an opinion of MRIS or Long & Foster Real Estate.