Buyers are out looking for homes, but they continue to find a market that doesn’t have sufficient inventory. Home sales were down in the Maryland suburbs of Washington, D.C., because fewer homes were on the market.

Buyers are out looking for homes, but they continue to find a market that doesn’t have sufficient inventory. Home sales were down in the Maryland suburbs of Washington, D.C., because fewer homes were on the market.

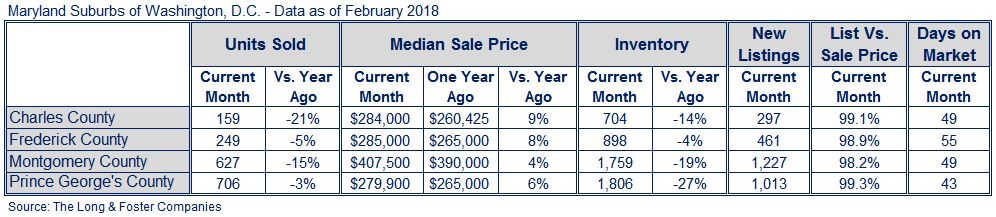

Long & Foster Real Estate’s Market Minute report for the Maryland beltway region includes Charles, Frederick, Montgomery and Prince George’s counties.

Homes across the Maryland-D.C. suburbs brought nearly full asking price. Inventory was down year-over-year, as much as 27 percent in Prince George’s County, and homes there sold the fastest – in 43 days on average.

Conditions favor sellers, and demand remains strong. Buyers are seeking to lock in today’s historically low interest rates, which are expected to rise moderately this year.

“In real estate, like the stock market, you like to buy low and sell high,” said Larry “Boomer” Foster, president of Long & Foster Real Estate. “If you sell your house today, at most price points you’re going to be selling high. You could make some money.”

Year-over-year price increases throughout the Mid-Atlantic are generally in the single-digit, 4 to 5 percent range, which is far from the run-up seen during the real estate bubble 10 years ago, Foster said.

The market is good for sellers who have lived in their homes for a few years and want to downsize or buy a move-up home, he said. If homeowners can find another home they want, they stand to realize tax-sheltered capital gains from selling.

Although many buyers are out looking, Foster said it’s more important than ever for a seller to choose a real estate professional to market their home and get the best price.

“Having a skilled Long & Foster agent to negotiate on your behalf will likely end up netting you more money,” Foster said. “You want a professional to price your home correctly, to expose it to the marketplace and to drum up maximum demand. What matters is the amount you put in your pocket when the sale goes through.”

The Long & Foster Market Minute is an overview of market statistics based on residential real estate transactions for more than 500 local areas and neighborhoods and over 100 counties in eight states. The easy-to-read, easy-to-share reports include information about each area’s units sold, active inventory, median sale prices, list to sold price ratio, days on market and more.

Information included in this report is based on data supplied by Metropolitan Regional Information System and its member associations of Realtors, which are not responsible for its accuracy. The reports include residential real estate transactions within specific geographic regions, not just Long & Foster sales, and they do not reflect all activity in the marketplace. Information contained in this report is deemed reliable but not guaranteed, should be independently verified, and does not constitute an opinion of MRIS or Long & Foster Real Estate.