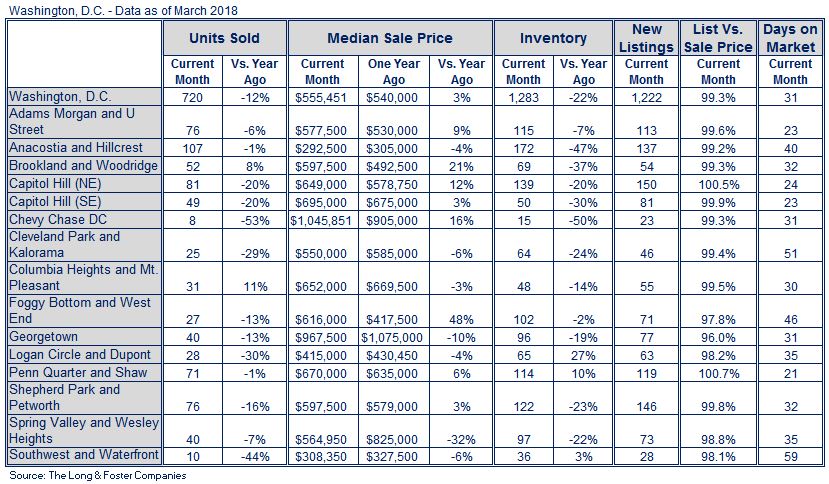

The number of homes for sale in the Washington, D.C., residential housing market slid by 22 percent in March, while prices went up by 3 percent.

The number of homes for sale in the Washington, D.C., residential housing market slid by 22 percent in March, while prices went up by 3 percent.

Tightening market conditions meant homes sold in as little as 21 days in the Penn Quarter and Shaw neighborhood, and buyers were willing to pay over asking price there as well as in Capitol Hill NE. The Long & Foster Market Minute report provides insight on data for 15 areas within Washington, D.C.

There was a 1.8-month supply of homes in the District in December, down from a supply of 2.0 months a year earlier. It’s generally considered a seller’s market when there’s less than a six-month supply of available homes.

A “perfect storm” of market conditions is compounding an ongoing inventory crunch, said Larry “Boomer” Foster, president of Long & Foster Real Estate. Builders’ margins are squeezed by rising labor and materials prices, so they are not meeting demand for entry-level and move-up homes. Would-be sellers of existing homes, many of whom refinanced at low interest rates, are reluctant to list their homes because they aren’t finding the selection of properties they want to move into.

“There has never been a better time to sell,” Foster said. “People who have homes that are ready to go on the market are going to be getting top dollar.”

He cautioned that for both buyers and sellers, it important to ask the right questions before enlisting the help of a real estate professional. Find out what services they offer and their track record of results, he said. For sellers, what is the agent’s ratio of final sale price to initial asking price, and how long are their clients’ homes on the market before selling? For buyers, how skilled is the agent at locating homes that might not be on the market yet, negotiating a contract, and getting to the closing table in a reasonable amount of time.

“You might think you’re getting a deal with a discount broker, but it ends up costing more in the long run,” Foster said. “If you get a broker who isn’t good at negotiation, can’t navigate the process, doesn’t know the contract or the marketplace – they hurt everybody. They especially hurt the consumer.”

The Long & Foster Market Minute is an overview of market statistics based on residential real estate transactions for more than 500 local areas and neighborhoods and over 100 counties in eight states. The easy-to-read, easy-to-share reports include information about each area’s units sold, active inventory, median sale prices, list to sold price ratio, days on market and more.

Information included in this report is based on data supplied by Metropolitan Regional Information System and its member associations of Realtors, which are not responsible for its accuracy. The reports include residential real estate transactions within specific geographic regions, not just Long & Foster sales, and they do not reflect all activity in the marketplace. Information contained in this report is deemed reliable but not guaranteed, should be independently verified, and does not constitute an opinion of MRIS or Long & Foster Real Estate.