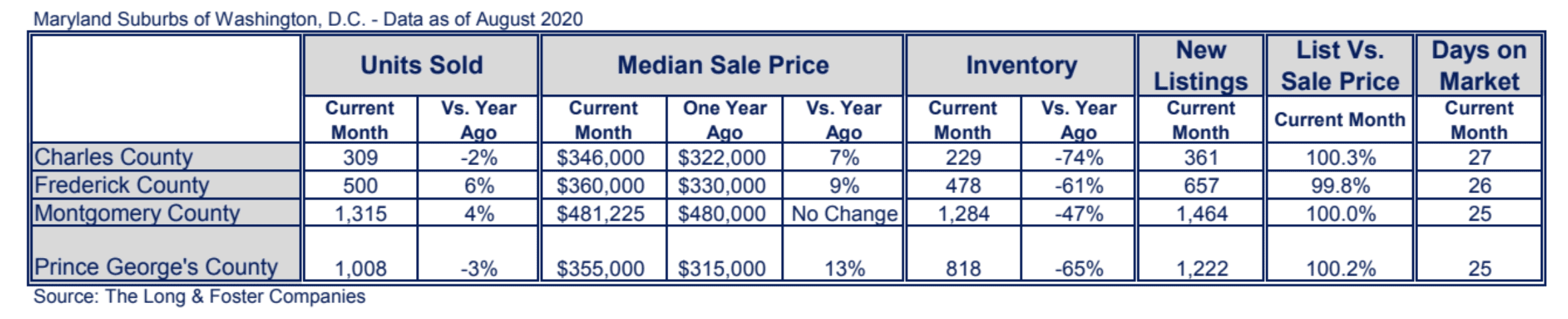

Half of the Suburban Maryland region experienced an incline in units sold in August, according to the Long & Foster Real Estate Market Minute Report. Frederick County saw an uptick of 6%, followed by Montgomery County with a 4% rise. Median sale prices showed incremental increases throughout the area, aside from Montgomery County which saw no year-over-year change. Inventory continued to decrease and days on market remained around a month, with homes selling within 25 to 27 days on average.

The Long & Foster Real Estate Market Minute report for the suburban Maryland region includes Charles, Frederick, Montgomery and Prince George’s counties.

“This fall market is going to be different from what we’ve seen in the past,” said Larry “Boomer” Foster, president of Long & Foster Real Estate. Since this year has experienced many unprecedented events, Foster believes the fall market will not have its typical slowdown. Mortgage rates and interest rates continue to be historically low and with demand for homes continuing to be incredibly high, the market is anticipated to continue to perform well.

“Consumer sentiment is going up, albeit quite slowly,” Foster mentioned. However, when taking into account the current pandemic and civil unrest, the current levels of consumer sentiment are still higher than expected at around 75. Considering consumer sentiment was 20 points lower at the height of the Great Recession in 2007 and 2008, Foster said that these levels are healthy.

Due to the recent stock market volatility, diversifying one’s real estate portfolio has become an attractive option for people looking for places to invest their money. While the stock market can fluctuate drastically from day to day, real estate is more stable and will provide four different investment advantages: appreciation, depreciation, cash flow and principle reduction.

To learn more about your local market conditions, visit Long & Foster’s Market Insights. You can also learn more about Long & Foster and find an agent at LongandFoster.com.