Median sale prices of homes increased in most parts of the Eastern Shore real estate market in August. The region’s market continues to show signs of growth despite low inventory, according to the Long & Foster Market Minute reports. The Eastern Shore market includes Worcester, Wicomico, Dorchester, Queen Anne’s, Talbot and Caroline counties.

Median sale prices of homes increased in most parts of the Eastern Shore real estate market in August. The region’s market continues to show signs of growth despite low inventory, according to the Long & Foster Market Minute reports. The Eastern Shore market includes Worcester, Wicomico, Dorchester, Queen Anne’s, Talbot and Caroline counties.

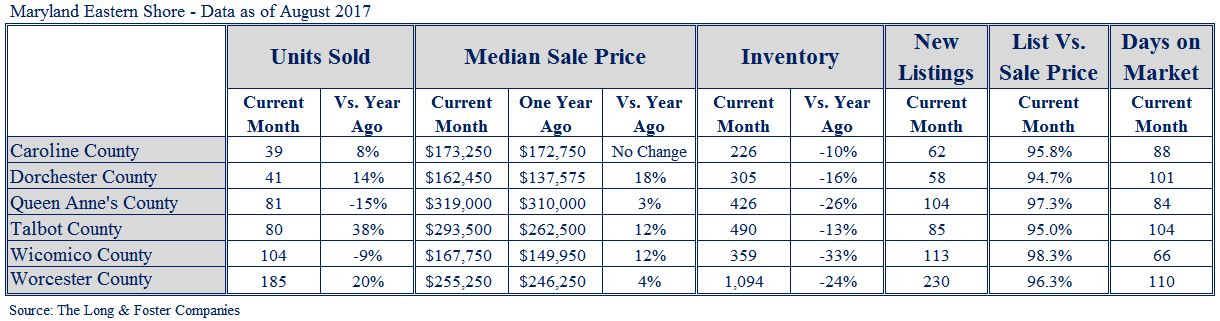

A number of parts of the Eastern Shore region saw an increase in home sales in August. In Talbot County, home sales rose by 38 percent, followed by a 20 percent increase in Worcester County. Median sale prices increased in all areas except Caroline County, where it remained unchanged. The largest increase was in Dorchester County, which rose by 18 percent.

“While we’ve seen good consistency throughout Long & Foster’s market area in recent months, the Eastern Shore has performed a bit better,” said Gary Scott, president of Long & Foster Real Estate. “The area has continued to see growth occurring, even though it faces some of the same inventory difficulties that are being seen in markets across the country.”

Active inventory declined by double digits in the Eastern Shore market, with Wicomico County experiencing a 33 percent decrease. Other areas saw drops of 10 percent to 26 percent. Homes in the region sold in about two to four months on average.

“Inventory is a challenge in every market in which we operate, and we believe inventory is an issue that is unlikely to go away overnight,” Scott said. “There are a lot of people who have financed, refinanced or purchased at very favorable interest rates during the recession and in recent years, and their motivation is different than it was for many in the past – they’re staying put.”

The inventory shortage is making purchasing a home particularly difficult for millennial buyers, Scott said. That’s not necessarily because millennials and older generations are competing to purchase the same homes, but more due to homeowners and investors choosing not to sell homes that millennials would be interested in purchasing, he said. Although new construction has increased, homebuilders are having a hard time meeting the demands of the market, he said.

“Many more people are moving toward smaller more effective, more efficient housing than the big boxes,” Scott said. “A lot of millennials are looking for maintenance-free, convenient living – like condos and townhouses – that is close to retail, entertainment and work opportunities.”

The best thing that homebuyers can do, Scott said, is to have their financing lined up, have an agent who is an expert negotiator at the ready and remember that real estate is hyperlocal. Within a single large subdivision, it’s possible to see homes in one part of the neighborhood sell quickly while homes in another part sell at a slower pace, he said. Long & Foster’s Market Minute reports allow consumers to view market data for individual communities and neighborhoods. Combining the information from regional and local reports, along with the neighborhood insight and expertise of a Long & Foster agent, can provide a much more rounded and accurate picture of the market, Scott said.

The Long & Foster Market Minute is an overview of market statistics based on residential real estate transactions for more than 500 local areas and neighborhoods and over 100 counties in eight states. The easy-to-read, easy-to-share reports include information about each area’s units sold, active inventory, median sale prices, list to sold price ratio, days on market and more.

Information included in this report is based on data supplied by Metropolitan Regional Information System and Coastal Association of Realtors and their member associations of Realtors, which are not responsible for its accuracy. The reports include residential real estate transactions within specific geographic regions, not just Long & Foster sales, and they do not reflect all activity in the marketplace. Information contained in this report is deemed reliable but not guaranteed, should be independently verified, and does not constitute an opinion of MRIS or Long & Foster Real Estate.