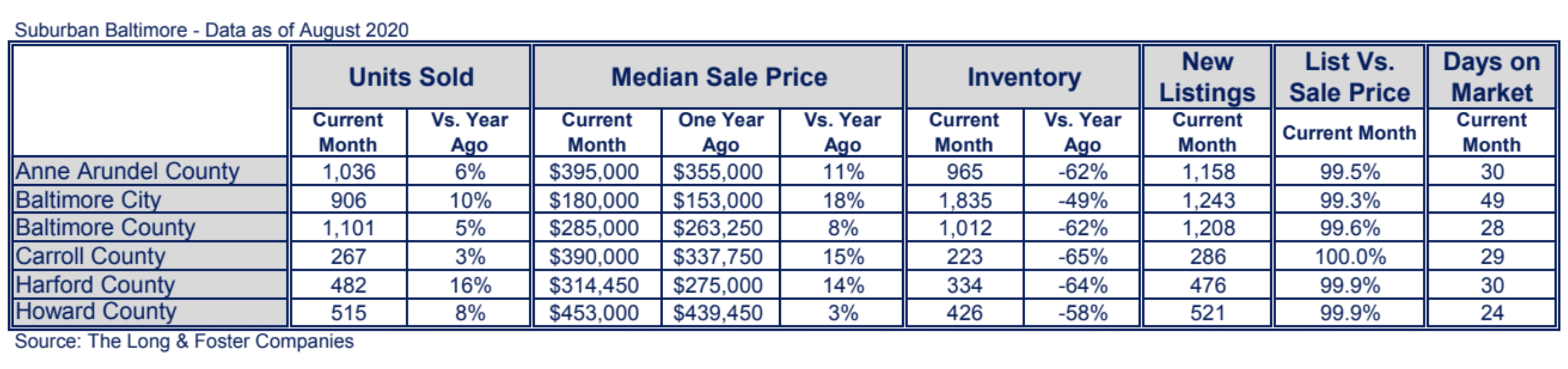

The median sales price of homes as well as the number of units sold increased across the Baltimore Region in August, according to the Long & Foster Real Estate Market Minute Report.

Baltimore City experienced an 18% increase in median sale price, followed by 15% in Carroll County. The number of homes sold also ticked upward across the region with Harford County leading the way at 16% followed by Baltimore City at 10%. Active inventory declined in the double digits throughout the region while the number of days a home stayed on the market ranged from 24 to 49.

The Long & Foster Real Estate Market Minute report for the Baltimore region includes Baltimore, Anne Arundel, Carroll, Howard and Harford counties and the city of Baltimore.

The fall housing market, which historically slows down, is expected to be quite strong this year. “In the fall of a presidential election year, we normally see a pull back in the housing market due to the uncertainty of the election,” said Gary Scott, president of Long & Foster Real Estate. “We believe this autumn will be different and we’re cautiously optimistic that low interest rates will drive the market, despite the pandemic, unemployment levels, social unrest and the upcoming election.”

With recent stock market volatility, consumers are taking advantage of low interest rates by purchasing real estate to diversify their portfolios. Real estate appreciates about 4% per year on average and generally does not go through massive price fluctuations, like the stock market.

“There’s never been a better time to borrow money, so it’s a great time to add an investment property to your portfolio,” said Scott. “Real estate investors can benefit from appreciation, depreciation, cash flow and equity build-up.” If you choose to diversify, it’s best to deploy your partners, such as your accountant and financial advisor, to help with your goals and objectives, Scott added.

COVID-19 (coronavirus) and low interest rates have changed consumer’s behavior very quickly. We are nearly at the highest rate of homeownership ever. Renters are determined to be buyers because of interest rates and others who were previously priced out of a certain market, can now afford to buy a home, resulting in higher homeownership rates.

To learn more about your local market conditions, visit Long & Foster’s Market Insights. You can also learn more about Long & Foster and find an agent at LongandFoster.com.