December brought an increase in median sale prices to areas of the suburban Maryland real estate market, according to The Long & Foster Market Minute reports. The Maryland suburbs include Charles, Frederick, Montgomery and Prince George’s counties. The Long & Foster Market Minute reports are based on data provided by Metropolitan Regional Information System and its member associations of Realtors and include residential real estate transactions within specific geographic regions, not just Long & Foster sales.

December brought an increase in median sale prices to areas of the suburban Maryland real estate market, according to The Long & Foster Market Minute reports. The Maryland suburbs include Charles, Frederick, Montgomery and Prince George’s counties. The Long & Foster Market Minute reports are based on data provided by Metropolitan Regional Information System and its member associations of Realtors and include residential real estate transactions within specific geographic regions, not just Long & Foster sales.

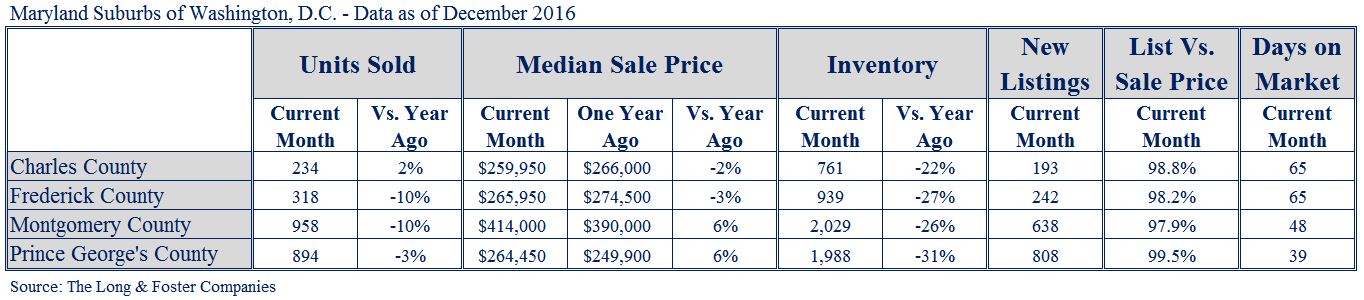

Median sale prices rose in parts of the suburban Maryland real estate market in December with both Montgomery and Prince George’s counties experiencing 6 percent increases. In Charles County, the median sale price declined by 2 percent, while it fell by 3 percent in Frederick County.

The number of homes sold declined in most of the suburban Maryland region in December when compared to the same month last year, though Charles County experienced a 2 percent increase. In Prince George’s County, the number of homes sold fell by 3 percent, followed by both Frederick and Montgomery counties, where it fell by 10 percent.

Inventory declined throughout the suburban Maryland market in December, dropping by 31 percent in Prince George’s County and 27 percent in Frederick County. Montgomery County experienced a 26 percent decline in active inventory, and in Charles County it fell by 22 percent.

Homes are selling at a steady pace throughout the region, with many selling in a little over two months or less on average. Prince George’s County experienced the shortest days on market (DOM) average of 39 days, while in Montgomery County homes sold in about 48 days on average. In both Charles and Frederick counties, the DOM average was 65 days.

“The positive trends we’ve been seeing in the U.S. economy continued in December, and though the real estate market is in its typical winter slowdown we still saw some good things happening, including in the suburban Maryland region,” said Jeffrey S. Detwiler, chief operating officer of The Long & Foster Companies. “We anticipate a strong 2017 real estate market where buyers will be able to take advantage of a number of factors like better FHA loan terms and mortgage rates ranging from 4-5 percent.”

The Long & Foster Market Minute is an overview of market statistics based on residential real estate transactions and presented at the county level. The easy-to-read and easy-to-share reports include information about each area’s units sold, active inventory, median sale prices, months of supply, new listings, new contracts, list to sold price ratio, and days on market. Featuring reports for more than 500 local areas and neighborhoods in addition to more than 100 counties in eight states, The Long & Foster Market Minute is offered to buyers and sellers as they aim to make well-informed real estate decisions.

The Long & Foster Market Minute reports are available at www.LongandFoster.com, and you can subscribe to free updates for the reports in which you’re interested. Information included in this report is based on data supplied by MRIS, which is not responsible for its accuracy. The reports do not reflect all activity in the marketplace. Information contained in this report is deemed reliable but not guaranteed, should be independently verified, and does not constitute an opinion of MRIS or Long & Foster Real Estate.