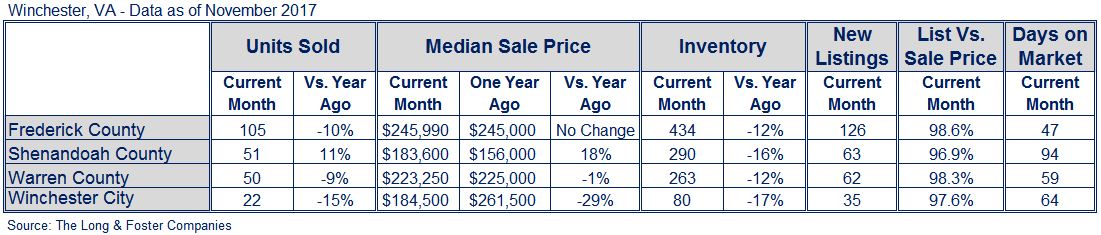

Home sales rose 11 percent in Shenandoah County in November but fell 15 percent in Winchester, according to the Long & Foster Market Minute reports. Meantime, the number of available homes dropped sharply compared to a year earlier in the region, which includes Frederick, Shenandoah and Warren counties and the city of Winchester.

Home sales rose 11 percent in Shenandoah County in November but fell 15 percent in Winchester, according to the Long & Foster Market Minute reports. Meantime, the number of available homes dropped sharply compared to a year earlier in the region, which includes Frederick, Shenandoah and Warren counties and the city of Winchester.

Across the Long & Foster footprint, homes considered more affordable in their respective markets are selling at a brisk pace, said Larry “Boomer” Foster, president of Long & Foster Real Estate.

“In the luxury space, there’s plenty of inventory, but entry-level homes – that’s tougher,” Foster said. “There’s no way to build quick enough to meet the demand, and baby boomers are staying in their homes longer than they ever have.”

Strong demand and low inventory usually result in price appreciation, and that’s what happened in Shenandoah County in November. Among Winchester area localities, prices rose the most – 18 percent – in Shenandoah County, while inventory fell 16 percent compared to a year earlier.

Foster recommended buyers work with a real estate agent to get prepared for any housing search. A buyer who has received preliminary approval for financing and enlisted the help of an agent who knows the market will have a greater chance at success getting an offer accepted, he said.

Foster predicted 2018 would bring more of the same, with strong employment, wage growth and low interest rates expected to remain forces shaping the housing market. Affordability could become more of a concern however, he said. Interest rates are expected to rise modestly, and home prices could continue to go up.

“Owning a home is a great investment and a great way to build wealth,” he said. “If you own a home, you’re in a pretty good place right now.”

Foster said he’s closely watching tax legislation making its way through the U.S. Congress, to see how homeowners will be affected. Measures to limit the amount of mortgage interest and local property taxes that homeowners may deduct could affect homeowners in the upper end of the market or in high-cost areas.

“It’s hard not to be concerned about that,” Foster said. “But I think people buy homes for reasons other than the tax breaks they might get. They buy homes for the security of having something that’s their own, to have an appreciating asset, to have a place to raise kids and grow their families in.”

The Long & Foster Market Minute is an overview of market statistics based on residential real estate transactions for more than 500 local areas and neighborhoods and over 100 counties in eight states. The easy-to-read, easy-to-share reports include information about each area’s units sold, active inventory, median sale prices, list to sold price ratio, days on market and more.

Information included in this report is based on data supplied by Metropolitan Regional Information System and its member associations of Realtors, which are not responsible for its accuracy. The reports include residential real estate transactions within specific geographic regions, not just Long & Foster sales, and they do not reflect all activity in the marketplace. Information contained in this report is deemed reliable but not guaranteed, should be independently verified, and does not constitute an opinion of MRIS or Long & Foster Real Estate.