The number of homes sold in Washington, D.C., increased in February, according to The Long & Foster Market Minute reports. Long & Foster Real Estate, the largest independent residential real estate company in the United States, has updated its neighborhood level versions of The Long & Foster Market Minute for 15 areas within Washington, D.C. The Long & Foster Market Minute reports are based on data provided by Metropolitan Regional Information System and its member associations of Realtors and include residential real estate transactions within specific geographic regions, not just Long & Foster sales.

The number of homes sold in Washington, D.C., increased in February, according to The Long & Foster Market Minute reports. Long & Foster Real Estate, the largest independent residential real estate company in the United States, has updated its neighborhood level versions of The Long & Foster Market Minute for 15 areas within Washington, D.C. The Long & Foster Market Minute reports are based on data provided by Metropolitan Regional Information System and its member associations of Realtors and include residential real estate transactions within specific geographic regions, not just Long & Foster sales.

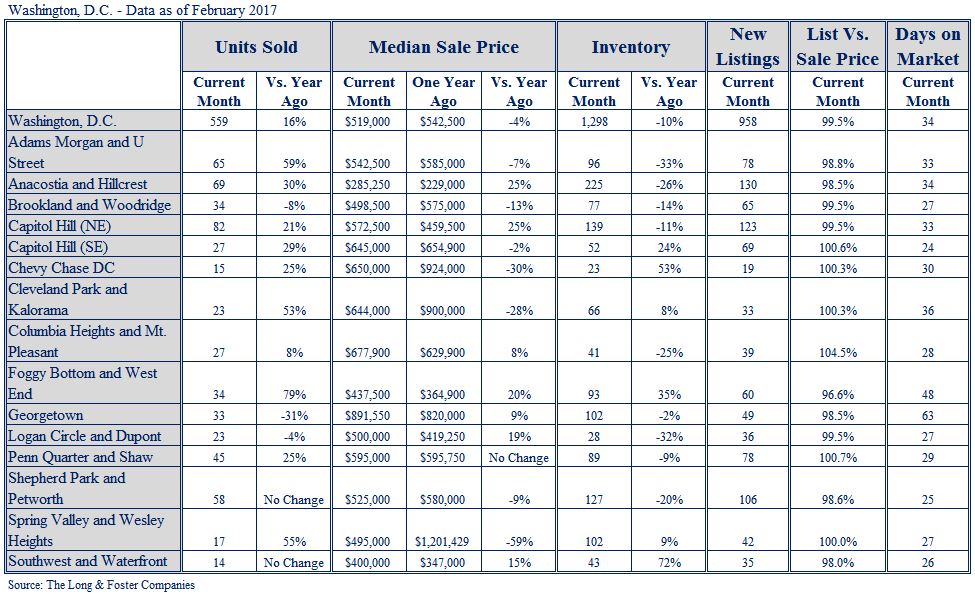

Overall, Washington, D.C., experienced a 16 percent increase in the number of homes sold in February compared to the previous year. The city experienced a 4 percent decrease in median sale price, though many individual neighborhoods saw median sale prices increase. Active inventory fell by 10 percent compared to the same month last year, and properties continued to sell at a quick pace, with the city seeing a days on market (DOM) average of 34 days.

Within Washington, D.C., a number of individual neighborhoods experienced increases in the number of homes sold in February. For example, the Foggy Bottom and West End neighborhood saw a 79 percent increase in number of units sold and the Adams Morgan and U Street neighborhood experienced a 59 percent increase. Additionally, the Spring Valley and Wesley Heights neighborhood experienced a 55 percent increase in the number of homes sold.

According to February data, the median sale price in Washington, D.C., declined by 4 percent compared to the same month last year, though several neighborhoods enjoyed significant growth. The median sale price in the neighborhoods of Anacostia and Hillcrest as well as Capitol Hill (NE) rose by 25 percent. Improvements were also made in the Foggy Bottom and West End neighborhood, which saw an increase of 20 percent. In the Logan Circle and Dupont neighborhood, the median sale price increased by 19 percent last month.

Active inventory decreased by 10 percent throughout Washington, D.C., in February compared to the prior year, with the Adams Morgan and U Street neighborhood experiencing a decrease of 33 percent. In the Logan Circle and Dupont neighborhood, active inventory fell by 32 percent, followed by the Anacostia and Hillcrest neighborhood where it decreased by 26 percent.

The District as a whole experienced a days on market (DOM) average of 34 days in February. The Capitol Hill (SE) neighborhood had a DOM average of 24 days, followed by the Shepherd Park and Petworth neighborhood with a DOM average of 25 days. In the Southwest and Waterfront neighborhood, the DOM average was 26 days.

“The United States economy continued to make gains in many areas in February, and at Long & Foster we saw positive indicators of growth in the real estate market as well, including in the Washington, D.C., area,” said Jeffrey S. Detwiler, chief operating officer of The Long & Foster Companies. “The number of homes sold continued to rise for many in the Mid-Atlantic and Northeast regions and, with continued high demand for homes, we expect to see a busy spring season.”

The Long & Foster Market Minute is an overview of market statistics based on residential real estate transactions and presented at the county level. The easy-to-read and easy-to-share reports include information about each area’s units sold, active inventory, median sale prices, months of supply, new listings, new contracts, list to sold price ratio, and days on market. Featuring reports for more than 500 local areas and neighborhoods in addition to more than 100 counties in eight states, The Long & Foster Market Minute is offered to buyers and sellers as they aim to make well-informed real estate decisions.

The Long & Foster Market Minute reports are available at www.LongandFoster.com, and you can subscribe to free updates for the reports in which you’re interested. Information included in this report is based on data supplied by MRIS, which is not responsible for its accuracy. The reports do not reflect all activity in the marketplace. Information contained in this report is deemed reliable but not guaranteed, should be independently verified, and does not constitute an opinion of MRIS or Long & Foster Real Estate.