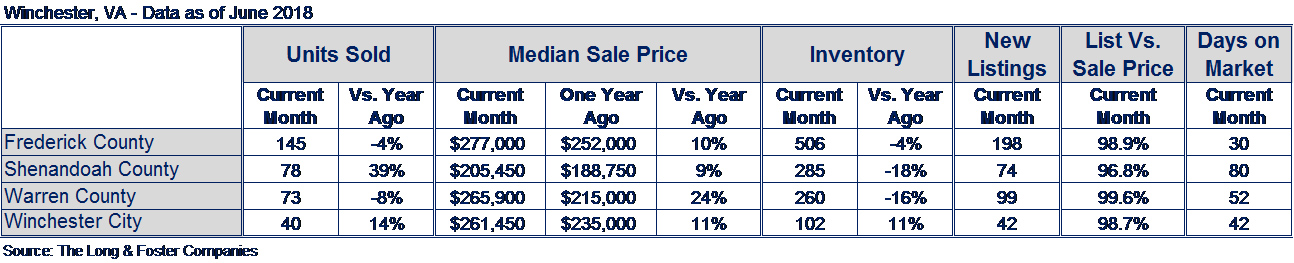

Median sale prices rose region-wide in and around Winchester in June, according to Long & Foster Market Minute reports. Inventory declined sharply in some areas – up to 18 percent in Shenandoah County.

Median sale prices rose region-wide in and around Winchester in June, according to Long & Foster Market Minute reports. Inventory declined sharply in some areas – up to 18 percent in Shenandoah County.

The region includes Frederick, Shenandoah and Warren counties and the city of Winchester.

Despite the sharp decline in the number of available homes, sales were up 39 percent in Shenandoah County compared to a year earlier. Median sale prices ranged from $188,750 in Shenandoah County to $277,000 in Frederick County. The price average increase over the four regions was 13.5 percent over a year earlier.

“June was not the kind of month we normally would expect, but most would agree that’s the result of having inventory contraction every month for the past three years,” said Larry “Boomer” Foster, president of Long & Foster Real Estate. “It’s challenging for buyers, but not for sellers, especially at the entry-level price point and a couple of levels up, in most markets.”

Agents and buyers should go into today’s competitive marketplace aware of the emotions involved in trying to secure a contract on a house, he said. Buyers may get into a bidding war, only to feel regretful later and drop out during the home inspection process. An experienced real estate agent will analyze the local market and advise clients on whether to walk away or escalate a bid.

“The market determines what the house is worth, and if there are a number of people willing to pay that price, that is the market price of the house,” Foster said. “If you look at home price appreciation over time, the curve is up. The quickest way to build wealth right now is to own real estate.”

The second half of 2018 is expected to mirror the first, with inventory tightening and continuing to impact the number of units sold. Economic fundamentals are strong, with historically high homeownership rates, along with solid consumer and builder confidence levels. Interest rates are expected to rise slightly, but still remain low relative to past rates. Builders’ margins are squeezed by rising tariffs on Canadian lumber and labor scarcity, which leads them to build larger, more expensive homes, Foster said.

“Builders are unable to build the product we need, which is entry-level houses,” he said. “But when you look at the metrics, we’re set up for a really strong real estate market.”

The Long & Foster Market Minute is an overview of market statistics based on residential real estate transactions for more than 500 local areas and neighborhoods and over 100 counties in eight states. The easy-to-read, easy-to-share reports include information about each area’s units sold, active inventory, median sale prices, list to sold price ratio, days on market and more.

Information included in this report is based on data supplied by Metropolitan Regional Information System and its member associations of Realtors, which are not responsible for its accuracy. The reports include residential real estate transactions within specific geographic regions, not just Long & Foster sales, and they do not reflect all activity in the marketplace. Information contained in this report is deemed reliable but not guaranteed, should be independently verified, and does not constitute an opinion of MRIS or Long & Foster Real Estate.