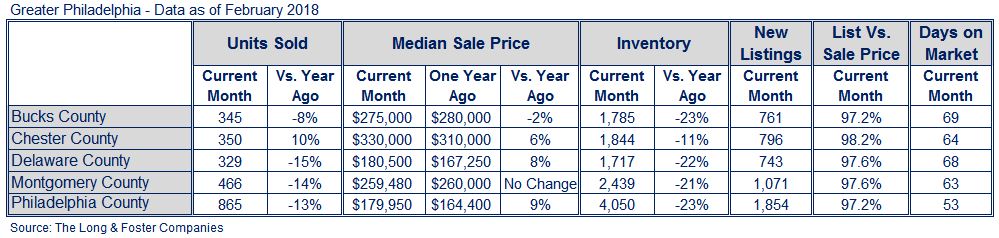

A few areas in the Philadelphia region’s real estate market saw median sale prices rise in February, according to the Long & Foster Market Minute reports. The Philadelphia region includes Bucks, Chester, Delaware, Montgomery and Philadelphia counties.

A few areas in the Philadelphia region’s real estate market saw median sale prices rise in February, according to the Long & Foster Market Minute reports. The Philadelphia region includes Bucks, Chester, Delaware, Montgomery and Philadelphia counties.

In Philadelphia County, the median sale price increased by 9 percent in February, followed by an 8 percent increase in Delaware County and a 6 percent increase in Chester County. Most areas of the Philadelphia market saw the number of homes sold decline, though home sales rose by 10 percent in Chester County.

“While we hoped to see the inventory declines ease a little bit in February, the significant volatility in the stock market created a cause for pause,” said Gary Scott, president of Long & Foster Real Estate. “That volatility will likely continue and although potential buyers may take a wait and see approach, we don’t think it will really change behavior.”

Throughout the Philadelphia market, active inventory declined by double digits. Both Bucks and Philadelphia counties experienced a 23 percent decrease in active inventory, while the smallest decrease was in Chester County at 11 percent. Homes in the region sold in about seven to 10 weeks on average. Philadelphia County experienced the lowest days on market average at 53 days.

“Philadelphia’s Main Line is one of the most challenged real estate markets because of high demand – it’s been an incredible explosion,” Scott said. “People there are looking for updated homes with walkable lifestyles and city amenities. At the upper end of the market, there is more available inventory but much of it is larger homes that lack the updates buyers want.”

There is a silver lining to the current market trends, Scott said. Inventory is low, prices are up in many places and, while interest rates are increasing, the increases aren’t at a level that is impacting affordability. That means it’s an excellent time to sell, he said.

“If selling your home is in the back of your mind, push it to the front of your mind,” Scott said. “The next 60 to 90 days will be an ideal time to sell a home. If your home is priced right, in good condition and in a good location, you’re going to sell your house.”

Scott said working with a Realtor can help sellers ensure they get the most out of the sale of their home. In its 2017 Profile of Home Buyers and Sellers, the National Association of Realtors found that homes listed for sale by owner sold for a median price of $190,000, while the median price of agent-assisted home sales was $250,000.

“The market is truly hyperlocal,” Scott said. “If there was ever a time that the public needed a trusted advisor and an expert who can help them navigate the market, it’s now. A professional can help ensure your home is priced correctly, gets maximum exposure and market demand, and can negotiate on your behalf.”

The Long & Foster Market Minute is an overview of market statistics based on residential real estate transactions for more than 500 local areas and neighborhoods and over 100 counties in eight states. The easy-to-read, easy-to-share reports include information about each area’s units sold, active inventory, median sale prices, list to sold price ratio, days on market and more.

Information included in this report is based on data supplied by TREND multiple listing service and its member associations of Realtors, which are not responsible for its accuracy. The reports include residential real estate transactions within specific geographic regions, not just Long & Foster sales, and they do not reflect all activity in the marketplace. Information contained in this report is deemed reliable but not guaranteed, should be independently verified, and does not constitute an opinion of TREND or Long & Foster Real Estate.