Median sale prices rose throughout the Philadelphia region’s real estate market in April, according to the Long & Foster Market Minute reports. The Philadelphia region includes Bucks, Chester, Delaware, Montgomery and Philadelphia counties.

Median sale prices rose throughout the Philadelphia region’s real estate market in April, according to the Long & Foster Market Minute reports. The Philadelphia region includes Bucks, Chester, Delaware, Montgomery and Philadelphia counties.

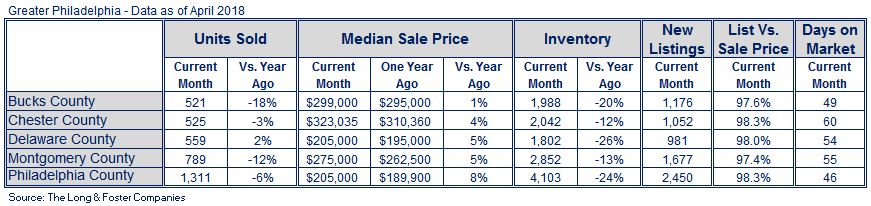

The entire Philadelphia region experienced increasing median sale prices in April when compared to the same month in 2017. Philadelphia County saw an 8 percent increase in median sale price, while both Delaware and Montgomery counties experienced a 5 percent increase. The number of homes sold fell in most parts of the region, though Delaware County experienced a 2 percent increase.

Active inventory levels fell throughout the Philadelphia real estate market last month. The smallest decline was seen in Chester County, where inventory fell by 12 percent. In Delaware County, active inventory dropped by 26 percent. Homes in the market sold at a quick pace, with days on market averages ranging from 46 days in Philadelphia County to 60 days in Chester County.

“Inventory levels have been declining across the country for three years, and while the Philadelphia real estate market has been hit hard by low inventory, we’re still seeing positive signs,” said Gary Scott, president of Long & Foster Real Estate. “Rising median sale prices cause some to worry that another real estate bubble may be on the horizon, but this market is very different than the one that led us into the recession.”

Scott said a number of factors made the pre-recession market susceptible, including the availability of credit and lack of regulations, the prevalence of adjustable rate mortgages, and home values that appreciated quickly in a very short time frame. Comparatively, it took 10 years of gradual increases for median sale prices to get to where they are now, he said.

The volatility of the stock market has resulted in many looking to the real estate market as a way to broaden their investment portfolio. Real estate investing is a great long-term strategy to build wealth that offers a number of benefits when planned well.

“There are a few key things to research and plan if you’re going to invest in real estate,” Scott said. “That includes trends in appreciation, vacancy rates, and supply and demand. You also need to establish clear goals and objectives.”

“Define your business rules and don’t deviate from them until it’s time to evaluate how your investments are performing,” he said. “Know what you can afford and what you can’t – consider the best case scenario, the worst case scenario and the most likely scenario. And have an appreciation and understanding that the real estate market changes.”

The Long & Foster Market Minute is an overview of market statistics based on residential real estate transactions for more than 500 local areas and neighborhoods and over 100 counties in eight states. The easy-to-read, easy-to-share reports include information about each area’s units sold, active inventory, median sale prices, list to sold price ratio, days on market and more.

Information included in this report is based on data supplied by TREND multiple listing service and its member associations of Realtors, which are not responsible for its accuracy. The reports include residential real estate transactions within specific geographic regions, not just Long & Foster sales, and they do not reflect all activity in the marketplace. Information contained in this report is deemed reliable but not guaranteed, should be independently verified, and does not constitute an opinion of TREND or Long & Foster Real Estate.