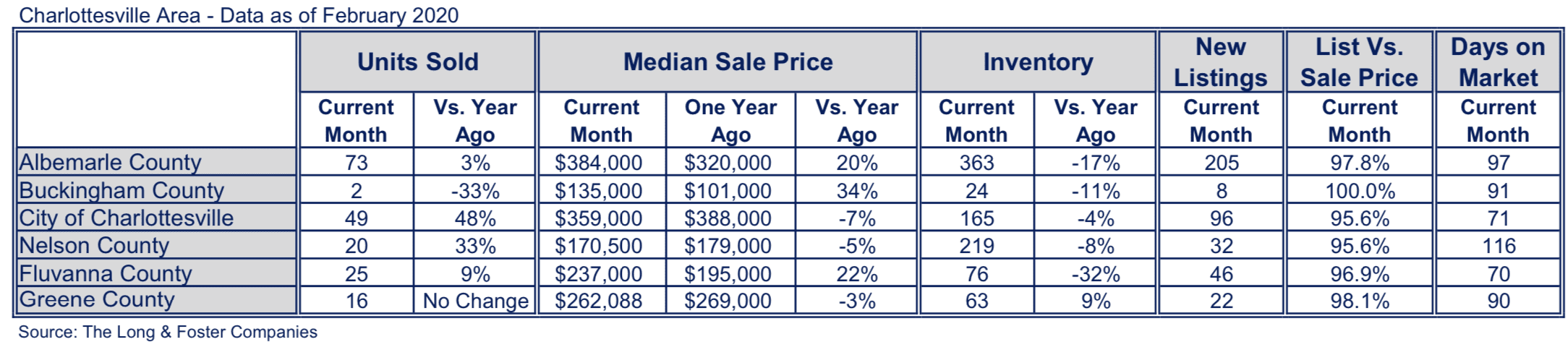

CHANTILLY, Va., March 18, 2020 – The number of homes sold in the Charlottesville Area rose throughout most of the region in February, according to the Long & Foster Real Estate Market Minute Report. The City of Charlottesville had a 48% upturn, while Buckingham County took a 33% fall.

Home sale prices varied across the area, with Buckingham County reporting a 34% increase, though the City of Charlottesville had a 7% decline. Inventory fell throughout most of the region, aside from Greene County which had a 9% rise. Other counties had decreases ranging from a 32% fall in Fluvanna County to a 4% fall in the City of Charlottesville.

Long & Foster Real Estate’s Market Minute report for the Charlottesville region includes the City of Charlottesville and Albemarle, Buckingham, Nelson, Fluvanna and Greene counties.

“For the most part you’re looking at moderate price appreciation and continuing inventory challenges,” said Larry “Boomer” Foster, president of Long & Foster Real Estate. While inventory continues to shrink there is still plenty of demand in most price-points.

The market is being affected in various ways currently due to world events, such as the coronavirus and the stock market fluctuations. However, Foster believes it is affecting the real estate market positively. “Investors are going to get their money out of equities and bonds and put it into real estate because that’s an appreciating asset,” he explained.

The main thing Foster thinks may be affected is consumer confidence. As of February, consumer confidence numbers were the highest in years, however current events may cause them to drop. There is no fear of a housing crisis though since home prices will continue to appreciate over time. In a normal expanding market, median home prices are expected to go up by 5% per year, in a recessionary market home prices still appreciate by 4%. It’s a tangible asset, unlike stocks and bonds, so it can provide consumers with multiple lines of revenue, from potential rent income to tax advantages.

To learn more about your local market conditions, visit Long & Foster’s Market Insights. You can also learn more about Long & Foster and find an agent at LongandFoster.com.