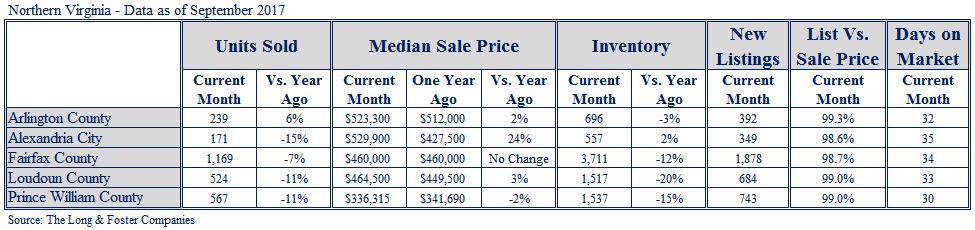

Lack of homes to buy pushed home sales lower in Northern Virginia in September as buyers snapped up properties that were priced well and move-in ready. Homes saw shorter times on the market than a year ago, for an average nearly 33 days area-wide, down from about 37 days the same month in 2016. The Northern Virginia market includes the city of Alexandria, and Arlington, Fairfax, Loudoun and Prince William counties.

Lack of homes to buy pushed home sales lower in Northern Virginia in September as buyers snapped up properties that were priced well and move-in ready. Homes saw shorter times on the market than a year ago, for an average nearly 33 days area-wide, down from about 37 days the same month in 2016. The Northern Virginia market includes the city of Alexandria, and Arlington, Fairfax, Loudoun and Prince William counties.

Inventory continued to lag – the number of homes on the market decreased by double digits in Fairfax, Loudoun and Prince William counties versus a year earlier. Part of the decrease was seasonal, with families staying in place during the month when many schools start their academic year.

Lack of inventory along with steady demand pushed prices higher in the region, up 5.4 percent overall compared to a year earlier. Alexandria saw a 24 percent jump in year-over-year prices, with the median price of a home rising to $529,900, the highest in the region. A few other areas of Northern Virginia experienced price increases accompanied by declines in inventory and units sold. Homes brought for nearly full asking price, as competition for desirable homes left little room for buyers to negotiate.

“The whole market is remarkable, but pretty consistent with what we’ve seen most other months of this year,” said Larry “Boomer” Foster, president of Long & Foster Real Estate.

Price declines in places like Prince William County, where inventory and units sold also fell, are likely an indication of the types of homes sold during that month, not a result of price depreciation. Prince William also has the lowest number of days on market in Northern Virginia, so properties are disappearing soon after they’re listed.

Homes are selling quickly if they are updated and move-in ready, Foster said. Buyers today, of whom millennials make up the largest generational cohort, lack the appetite for home improvement that previous generations showed. Even at a discount, a fixer upper will likely take longer to sell.

“Millennials have other things they would rather be doing,” Foster said. “They like traveling and philanthropic pursuits, not a two- or three-month project in the home they just bought.”

The Long & Foster Market Minute is an overview of market statistics based on residential real estate transactions for more than 500 local areas and neighborhoods and over 100 counties in eight states. The easy-to-read, easy-to-share reports include information about each area’s units sold, active inventory, median sale prices, list to sold price ratio, days on market and more.

Information included in this report is based on data supplied by Metropolitan Regional Information System and its member associations of Realtors, which are not responsible for its accuracy. The reports include residential real estate transactions within specific geographic regions, not just Long & Foster sales, and they do not reflect all activity in the marketplace. Information contained in this report is deemed reliable but not guaranteed, should be independently verified, and does not constitute an opinion of MRIS or Long & Foster Real Estate.