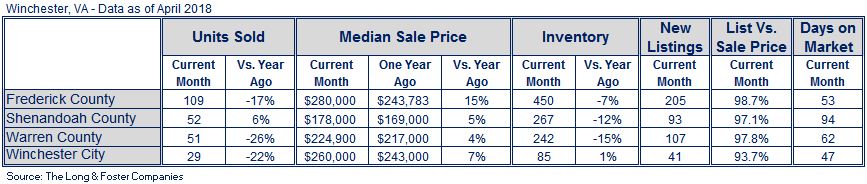

Homes sales dropped in the Winchester area in April compared to a year earlier, while prices increased. Buyers had fewer properties to choose from compared to a year ago, according to Long & Foster Market Minute reports.

Homes sales dropped in the Winchester area in April compared to a year earlier, while prices increased. Buyers had fewer properties to choose from compared to a year ago, according to Long & Foster Market Minute reports.

The region includes Frederick, Shenandoah and Warren counties and the city of Winchester.

Warren County saw a 26 percent decline in the number of homes sold, while inventory dropped 15 percent. Region-wide, homes were bringing near-asking price. The amounts buyers were willing to pay rose by 15 percent in Frederick County and single digit percentages across the rest of the region.

Nationally, housing inventory has declined for nearly three years running, while demand has remained strong. With low unemployment, interest rates that are low but rising, and modest wage growth, consumers are still shopping for houses and not finding enough supply to meet demand. This puts upward pressure on prices, and values are now at all-time highs in many areas.

Larry “Boomer” Foster, president of Long & Foster Real Estate, said he’s not perceiving signs of a bubble, even with month-after-month sale price increases, because of key economic indicators and strong lending standards.

“This is very different from 2000-2005,” Foster said. “Back then, people were getting loans who could not afford to pay them back, which created an artificial bubble, from a price perspective. Lenders are more regulated now, so that borrowers have to meet standards and in most cases put some money down. The employment situation is strong, and the fundamentals are sound; I don’t see this as a bubble.”

However, Foster said ongoing monthly, double-digit percentage price increases seen in some areas could eventually mean too few buyers could afford homes in those markets, and there would likely be a price correction if that happens.

Real estate remains a solid choice for investors looking to diversify and find a counter balance to stock market volatility, Foster said. For buy-and-hold investors making an educated and well-advised purchase, it could be a good time to buy real estate in many markets, he said.

“If you’re investing to hold because you want cash flow and someone else to pay down your mortgage, plus the tax benefits and appreciation,” he said, “there are many great places all over our footprint where people can diversify out of a very volatile situation with the stock market.”

The Long & Foster Market Minute is an overview of market statistics based on residential real estate transactions for more than 500 local areas and neighborhoods and over 100 counties in eight states. The easy-to-read, easy-to-share reports include information about each area’s units sold, active inventory, median sale prices, list to sold price ratio, days on market and more.

Information included in this report is based on data supplied by Metropolitan Regional Information System and its member associations of Realtors, which are not responsible for its accuracy. The reports include residential real estate transactions within specific geographic regions, not just Long & Foster sales, and they do not reflect all activity in the marketplace. Information contained in this report is deemed reliable but not guaranteed, should be independently verified, and does not constitute an opinion of MRIS or Long & Foster Real Estate.