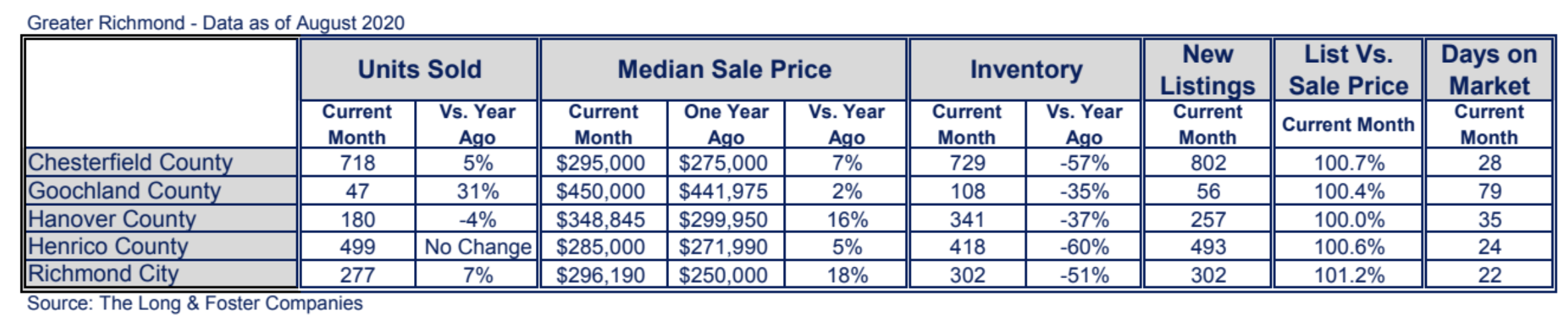

A rise in median sale price was experienced throughout the Richmond region in August, according to Long & Foster Real Estate’s Market Minute Report. In Richmond City, the median sale price rose by 18%, followed by a 16% incline in Hanover County.

The number of homes sold increased in most parts of the region. Goochland County led the way with a 31% jump. Hanover County exhibited a 4% decline in the number of homes sold and Henrico county had no change. Year-over-year inventory once again fell in the double digits across the entire region.

The Long & Foster Real Estate Market Minute report for the Richmond region includes Chesterfield, Henrico, Goochland and Hanover counties, and the city of Richmond.

The fall housing market, which historically slows down, is expected to be quite strong this year. “In the fall of a presidential election year, we normally see a pull back in the housing market due to the uncertainty of the election,” said Gary Scott, president of Long & Foster Real Estate. “We believe this autumn will be different and we’re cautiously optimistic that low interest rates will drive the market, despite the pandemic, unemployment levels, social unrest and the upcoming election.”

With recent stock market volatility, consumers are taking advantage of low interest rates by purchasing real estate to diversify their portfolios. Real estate appreciates about 4% per year on average and generally does not go through massive price fluctuations, like the stock market.

“There’s never been a better time to borrow money, so it’s a great time to add an investment property to your portfolio,” said Scott. “Real estate investors can benefit from appreciation, depreciation, cash flow and equity build-up.” If you choose to diversify, it’s best to deploy your partners, such as your accountant and financial advisor, to help with your goals and objectives, Scott added.

COVID-19 (coronavirus) and low interest rates have changed consumer’s behavior very quickly. We are nearly at the highest rate of homeownership ever. Renters are determined to be buyers because of interest rates and others who were previously priced out of a certain market, can now afford to buy a home, resulting in higher homeownership rates.

To learn more about your local market conditions, visit Long & Foster’s Market Insights. You can also learn more about Long & Foster and find an agent at LongandFoster.com.