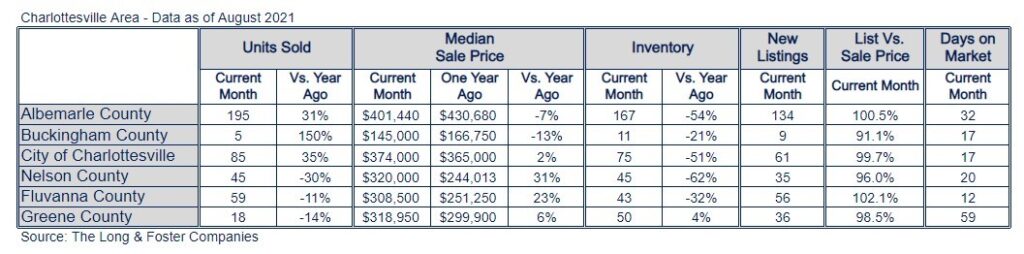

The Charlottesville Area saw an upward trend in median sale prices across most of the region in August, according to the Long & Foster Real Estate Market Minute Report.

Last August, the median sale price for Charlottesville Area Homes was $335,803. This August, the median sale price was $360,000, an increase of 7% or $24,197 compared to last year. The current median sold price is 8% lower than in July.

Versus August 2020, the total number of homes available this August was lower by 366 units or 49%. The total number of active inventory homes this August was 380 compared to 746 in August 2020.

The average number of days on market was 26, lower than the average last year, which was 60, a decrease of 57%.

The Long & Foster Real Estate’s Market Minute report for the Charlottesville region includes the City of Charlottesville and Albemarle, Buckingham, Nelson, Fluvanna and Greene counties.

We asked Larry “Boomer” Foster, president of Long & Foster Real Estate for his comments on what’s happening in the fall real estate market. “While inventory remains low, demand is still high and homes are selling near 100% of their list price, so it’s still a hot market,” said Foster. “Normally in the fall, there are not as many homes on the market as there are from January to Mother’s Day.”

Foster stated real estate is hyper-local, but in and around the D.C. area, even where inventory is shrinking, it’s not shrinking at rates of 50% to 70% as it did in the past – so it’s a lot healthier market for buyers and sellers.

“Home prices have moderated but have not declined,” said Foster. “When we see more homes on the market than demand, then we’ll see prices moderate even more.”

Inflation has increased, causing the cost of goods to rise. We asked Foster for his thoughts on what impact, if any, inflation is having on the housing market. “When we see a rise in the price of goods, homes, and interest rates all at the same time, would-be buyers will become renters,” said Foster. “Unless incomes keep up with inflation, many won’t be able to afford a home.”

The good news is interest rates are still low, creating a window of opportunity to lock in at today’s low rates for the long term, hedging inflation and taking advantage of the home’s appreciation in the years to come.

To learn more about your local market conditions, visit Long & Foster’s Market Insights. You can also learn more about Long & Foster and find an agent at LongandFoster.com.