The Washington, D. C. region’s long run of tight housing inventory finally showed some signs of relief in September, according to the Long & Foster Real Estate Market Minute Report.

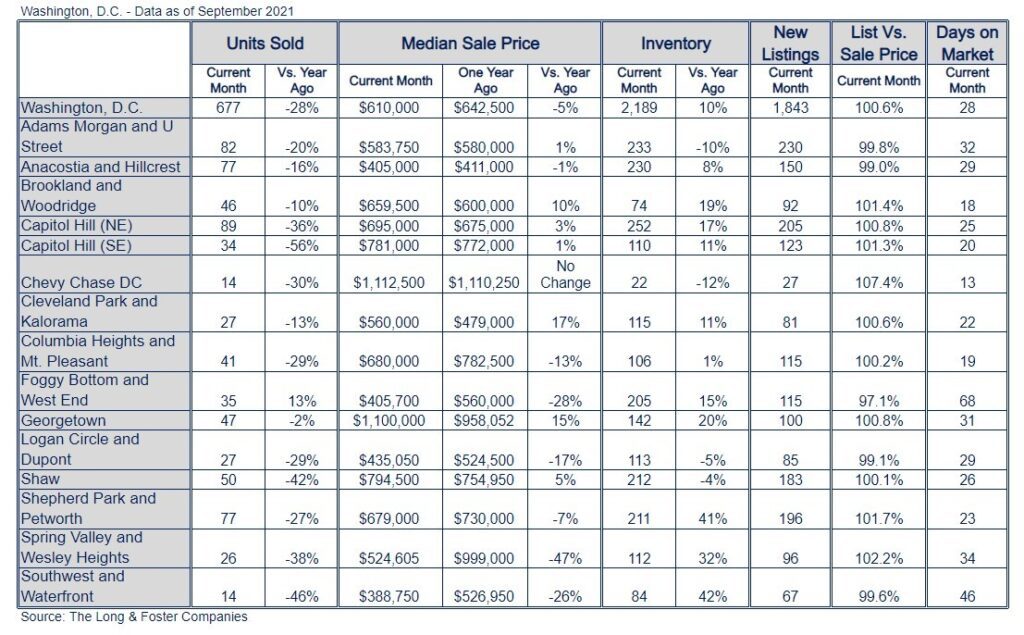

Versus September 2020, the total number of homes available this September was higher by 190 units or 10%. Active inventory increased by 26% in September 2021 compared to August 2021.

In September, the average sale price in Washington D.C. was 100.6% of the average list price, which is similar to September 2020.

Demand is still high for homes. The average number of days on the market this September was 28, higher than the 23-day average seen in September 2020.

The Long & Foster Real Estate Market Minute report provides data for 15 neighborhood areas within Washington, D.C.

We asked Larry “Boomer” Foster, president of Long & Foster Real Estate for his comments on what’s happening in the fall real estate market. “While inventory remains low, demand is still high and homes are selling near 100% of their list price, so it’s still a hot market,” said Foster. “Normally in the fall, there are not as many homes on the market as there are from January to Mother’s Day.”

Foster stated real estate is hyper-local, but in and around the D.C. area, even where inventory is shrinking, it’s not shrinking at rates of 50% to 70% as it did in the past – so it’s a lot healthier market for buyers and sellers.

“Home prices have moderated but have not declined,” said Foster. “When we see more homes on the market than demand, then we’ll see prices moderate even more.”

Inflation has increased, causing the cost of goods to rise. We asked Foster for his thoughts on what impact, if any, inflation is having on the housing market. “When we see a rise in the price of goods, homes, and interest rates all at the same time, would-be buyers will become renters,” said Foster. “Unless incomes keep up with inflation, many won’t be able to afford a home.”

The good news is interest rates are still low, creating a window of opportunity to lock in at today’s low rates for the long term, hedging inflation and taking advantage of the home’s appreciation in the years to come.

To learn more about your local market conditions, visit Long & Foster’s Market Insights. You can also learn more about Long & Foster and find an agent at LongandFoster.com.