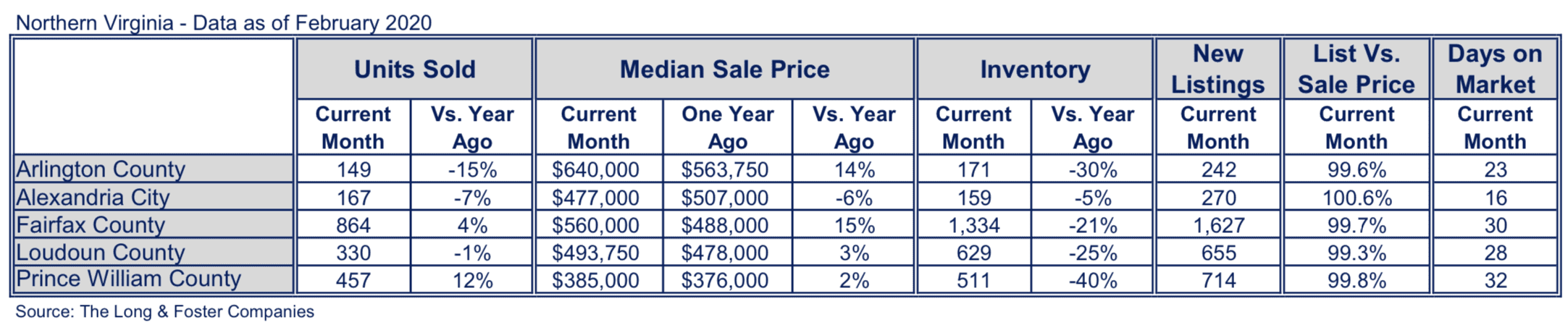

Median home sales prices rose across most of the Northern Virginia region in February, according to the Long & Foster Real Estate Market Minute Report. Aside from Alexandria City, which saw a slight decline of 6%; other counties displayed increases ranging from a 2% rise in Prince William County to a 15% incline in Fairfax County.

Inventory continued to drop, which subsequently led to the number of homes sold to fall as well. Prince William County had the largest fall in inventory with a 40% decline, while Arlington County had the biggest decrease in homes sold with a 15% fall. The days on market shrunk with Alexandria City displaying the smallest average with 16 days on market.

The Long & Foster Real Estate Market Minute report for Northern Virginia includes the city of Alexandria, and Arlington, Fairfax, Loudoun and Prince William counties.

“The market is very brisk right now with plenty of demand in most price-points,” said Larry “Boomer” Foster, president of Long & Foster Real Estate. “New entrants in the market have caused days on market to shrink considerably.”

However, now is a great time to start investing in real estate or diversifying your portfolio. “With the constant fluctuations in the stock market, many investors are moving away from equities and bonds and instead putting their money into real estate,” Foster explained. This is common during uncertain times as real estate is a tangible asset that appreciates over time. Real estate also provides multiple lines of revenue, from tax advantages to potential rental income.

Even with the uncertain global economy right now, Foster thinks people will continue shopping. The internet has made it especially easy for consumers to visualize a house and surrounding neighborhood, especially with the advent of virtual tours. While the coronavirus may discourage some from going to open houses, potential homebuyers still have options to view homes without having to step in one.

Foster believes that COVID-19 will cause some disruption in the market, though he thinks it will mainly affect consumer confidence. In February, consumer confidence was the highest in years, however with the continued spread of the coronavirus, it may begin to dip. Overall, he remains positive about the market since there is a lot of demand, interest rates are low and buying power is up.

To learn more about your local market conditions, visit Long & Foster’s Market Insights. You can also learn more about Long & Foster and find an agent at LongandFoster.com.