The median sale price increased in the Washington, D.C., real estate market last month, according to The Long & Foster Market Minute reports. Long & Foster Real Estate, the largest independent residential real estate company in the United States, has updated its neighborhood level versions of The Long & Foster Market Minute for 15 areas within Washington, D.C. The Long & Foster Market Minute reports are based on data provided by Metropolitan Regional Information System and its member associations of Realtors and include residential real estate transactions within specific geographic regions, not just Long & Foster sales.

The median sale price increased in the Washington, D.C., real estate market last month, according to The Long & Foster Market Minute reports. Long & Foster Real Estate, the largest independent residential real estate company in the United States, has updated its neighborhood level versions of The Long & Foster Market Minute for 15 areas within Washington, D.C. The Long & Foster Market Minute reports are based on data provided by Metropolitan Regional Information System and its member associations of Realtors and include residential real estate transactions within specific geographic regions, not just Long & Foster sales.

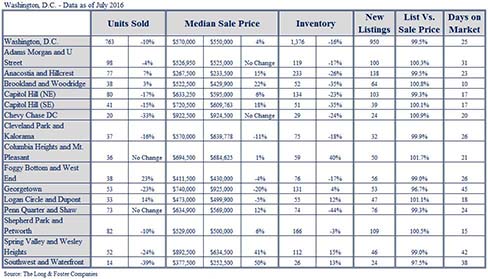

Overall, Washington, D.C., experienced a 10 percent decrease in the number of homes sold year-over-year, though properties continue to sell at a quick pace, with the city seeing a days on market (DOM) average of 25 days. Active inventory fell by 16 percent in the city compared to the same month in 2015. The median sale price of homes sold in Washington, D.C., rose by 4 percent when compared to the previous year, though many individual neighborhoods in the city continued to outperform the District as a whole.

Within Washington, D.C., a number of individual neighborhoods experienced increases in the number of homes sold in July. For example, the Foggy Bottom and West End neighborhood saw a 23 percent increase in number of units sold and the Logan Circle and Dupont neighborhood saw a 14 percent increase. Additionally, the Anacostia and Hillcrest neighborhood experienced a 7 percent increase.

According to July data, the median sale price in Washington, D.C., increased by 4 percent compared to the same month in 2015, and several neighborhoods enjoyed significant growth. The median sale price in the Southwest and Waterfront neighborhood jumped by 50 percent, and significant improvements were also made in the Spring Valley and Wesley Heights neighborhood, which saw an increase of 41 percent. In the Brookland and Woodridge neighborhood, the median sale price increased by 22 percent last month.

Active inventory decreased by 16 percent throughout the city in July. The Penn Quarter and Shaw neighborhood saw a decrease of 44 percent, followed by both the Brookland and Woodridge neighborhood and the Capitol Hill (SE) neighborhood, each with a 35 percent drop. The Anacostia and Hillcrest neighborhood saw a decrease of 26 percent.

The District experienced a days on market (DOM) average of 25 days in July. The Brookland and Woodridge neighborhood experienced an average marketing period of just 10 days, followed by the Shepherd Park and Petworth neighborhood with a DOM of 15 days. The neighborhoods of Capitol Hill (NE) and Capitol Hill (SE) both had a DOM average of 17 days.

“July brought both good and not-so-good news to the U.S. economy, with the job market remaining strong and retail sales staying flat for the month. Similarly in real estate, home sales slowed in many areas, while median sale prices increased, including in the Washington, D.C., region,” said Jeffrey S. Detwiler, chief operating officer of The Long & Foster Companies. “As the summer comes to a close, we anticipate that the housing market will remain healthy heading into the autumn season.”

The Long & Foster Market Minute is an overview of market statistics based on residential real estate transactions and presented at the county level. The easy-to-read and easy-to-share reports include information about each area’s units sold, active inventory, median sale prices, months of supply, new listings, new contracts, list to sold price ratio, and days on market. Featuring reports for more than 500 local areas and neighborhoods in addition to more than 100 counties in eight states, The Long & Foster Market Minute is offered to buyers and sellers as they aim to make well-informed real estate decisions.

The Long & Foster Market Minute reports are available at www.LongandFoster.com, and you can subscribe to free updates for the reports in which you’re interested. Information included in this report is based on data supplied by MRIS, which is not responsible for its accuracy. The reports do not reflect all activity in the marketplace. Information contained in this report is deemed reliable but not guaranteed, should be independently verified, and does not constitute an opinion of MRIS or Long & Foster Real Estate.