November brought growth to a number of areas of the Eastern Shore real estate market, including rising home sales and median sale prices. Overall, it was a good month for many of Long & Foster’s markets, according to the Long & Foster Market Minute reports. The Eastern Shore market includes Worcester, Wicomico, Dorchester, Queen Anne’s, Talbot and Caroline counties.

November brought growth to a number of areas of the Eastern Shore real estate market, including rising home sales and median sale prices. Overall, it was a good month for many of Long & Foster’s markets, according to the Long & Foster Market Minute reports. The Eastern Shore market includes Worcester, Wicomico, Dorchester, Queen Anne’s, Talbot and Caroline counties.

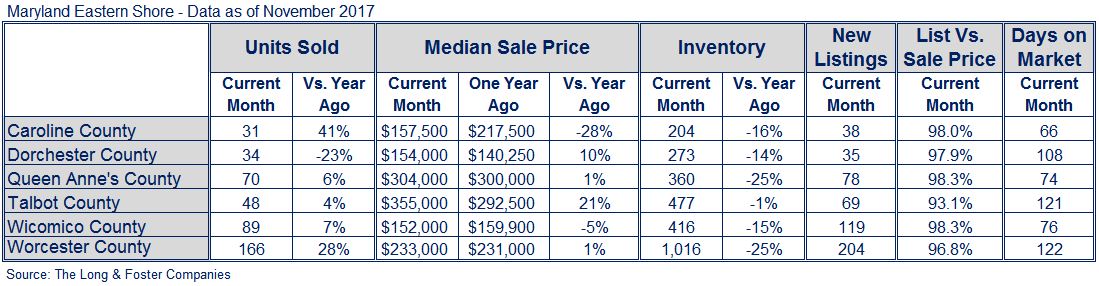

In November, most areas of the Eastern Shore experienced an increase in the number of homes sold. In Caroline County, the number of units sold rose by 41 percent, followed by Worcester County with a 28 percent increase. Median sale prices also increased in a number of areas, such as in Talbot County where the median sale price increased by 21 percent.

“November was a very healthy month for home sales, though there will always be areas that are outliers, which is why it’s so important to know what’s happening in your hyperlocal market,” said Gary Scott, president of Long & Foster Real Estate. “For example, while many places are seeing low days on market averages, in places like the Eastern Shore, these numbers tend to be higher because there are significantly more vacation homes, which often have higher price points.”

Active inventory decreased in all areas of the Eastern Shore region, including by 25 percent in both Queen Anne’s and Worcester counties. Homes in the region are selling in about two to five months on average, with Caroline County experiencing the lowest average days on market at 66 days.

Scott said the lack of inventory is not going to go away in the foreseeable future, and is most challenging for first-time homebuyers. He said first-time homebuyers in fast-moving markets need to make sure they’re ready to buy when they find a home they like.

“First-time homebuyers often don’t have as many funds available for a down payment,” Scott said. “In scenarios where multiple offers are being made on a property, those who are selling a home to purchase a new one have the advantage of recent years of price appreciation that provides them a larger down payment.”

“If a first-time homebuyer isn’t ready to make the purchase someone else will be,” Scott said. “They can’t get caught up in the conundrum of searching. They may be looking for a home with shiny new features that simply isn’t available at their price point.”

It’s also important for homeowners and homebuyers at all levels to remain aware of what happens in terms of taxes, Scott said.

“It will have an impact on homeownership, we just don’t know what, when and how long it will take. It’s probably a lot more bark than bite, but uncertainty creates fear,” Scott said. “Something to keep in mind though, is that homeownership hasn’t always been an economic decision where the goal is a tax write off. We can’t forget that, for many, owning a home is also emotional – it’s a way to have a place of one’s own to create memories and have the quality of life they want.”

The Long & Foster Market Minute is an overview of market statistics based on residential real estate transactions for more than 500 local areas and neighborhoods and over 100 counties in eight states. The easy-to-read, easy-to-share reports include information about each area’s units sold, active inventory, median sale prices, list to sold price ratio, days on market and more.

Information included in this report is based on data supplied by Metropolitan Regional Information System and Coastal Association of Realtors and their member associations of Realtors, which are not responsible for its accuracy. The reports include residential real estate transactions within specific geographic regions, not just Long & Foster sales, and they do not reflect all activity in the marketplace. Information contained in this report is deemed reliable but not guaranteed, should be independently verified, and does not constitute an opinion of MRIS, CAR or Long & Foster Real Estate.